Self Managed Superannuation

Maximise the potential of your retirement wealth.

Economic conditions fluctuate and the rules of superannuation are always changing. It’s vitally important to keep on top of the market if you’re going to make the most of self-managed super.

Camphin Boston provides exceptional accounts preparation, audit and technical compliance advice to people with a single fund straight through to professional service providers who administer multiple funds.

Top tips for wealth management

Benefits of a SMSF

Greater control over your investments and retirement savings

Flexibility in investment choices, including the ability to invest in property

Tax benefits, such as potentially lower tax rates on investment income and capital gains

The ability to pool retirement savings with up to four members, such as family members, to increase investment opportunities and reduce costs.

Let's talk about Self Managed Superannuation

-

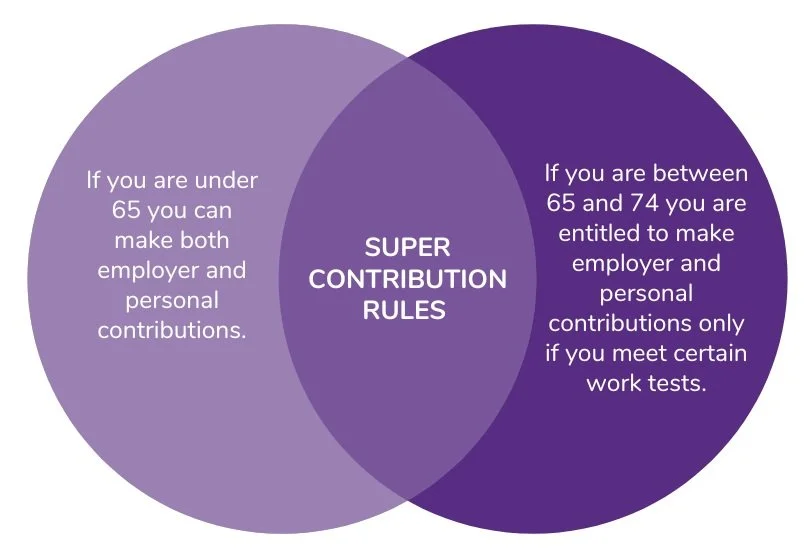

You can make contributions to super dependent on the age bracket you are in.

If you are under 65 you can make both employer and personal contributions.

If you are between 65 and 74 you are entitled to make employer and personal contributions only if you meet certain work tests.

-

Under current legislation you may begin accessing your superannuation benefit via a transition to retirement income stream (‘TRIS’) when you reach preservation age (currently 55).

Otherwise, you can commence a pension after you have reached preservation age and you retire, you reach 65 years of age or upon death.

However, you may be entitled to access benefits earlier if you are permanently incapacitated, suffer severe financial hardship or on other compassionate grounds.

There may be good reasons to begin a TRIS or accounts based pension as soon as you are eligible to reduce capital gains tax within the super fund or as part of a personal tax minimisation strategy.

-

There is no minimum amount required to set up a self managed fund and there are different reasons why people establish their funds.

Often it is the control over investment decisions, access to gearing your fund via limited recourse borrowing arrangements, reduced costs by having both spouse’s benefits in the one fund, or access to a wider selection of investment options, such as an investment property in your fund that influence people to establish a SMSF.

Self Managed Super Funds can also be part of your overall tax minimisation strategy and are attractive vehicles to hold your wealth as you approach retirement.

Under current rules once you turn 60 and commence a pension the assets supporting that pension are exempt from capital gains tax and the pension you receive is tax free.

-

In order to be a complying superannuation fund and continue to be taxed at 15%, the central management and control of the Fund must remain in Australia.

Careful planning is required before moving overseas to ensure your non-resident status will not result in your Fund being taxed at the highest marginal rate. Power of attorney and other strategies exist to protect your member balance from excessive tax.

-

Since September 2007, SMSFs have been able to borrow to acquire assets. It’s important to recognise that as there are strict rules surrounding this, you should always seek professional advice.

Your SMSF can only borrow to acquire assets that it would otherwise be allowed to acquire – so in some cases your SMSF could borrow to acquire the member’s business premises. Be careful though as the SMSF cannot use the borrowings to improve the property (no extensions or renovations), so what you buy must remain in the same state until your SMSF has paid off the loan.

Nicole Boutsalis

Director - Business Services